Future life focused

Pathways to sustainability in risk advice

An Ensombl adviser insights research paper

In this special production

About this paper

This paper has been prepared by Ensombl as a resource for financial advisers, with the support of Australian life insurer TAL.

We would like to thank the following adviser and expert contributors:

Introduction

In recent years, life insurance, or risk, advice has undergone more change than almost any other aspect of advice.

The compounding impacts of changes driven by the Life Insurance Framework (LIF) and Hayne Royal Commission have seen a disproportionately large drop in the number of advisers actively recommending risk.

While the Australian Government accepted the QAR recommendation for commissions to continue to support consumer access to life insurance advice, advisers report that the current LIF caps on commissions remain a barrier to some advisers re-entering this space.

While it is increasingly clear that this level of commission challenges the viability of many traditional risk advice models, a cohort of forward-thinking advisers are taking a fresh perspective, finding innovative new ways to incorporate risk into their advice proposition in ways that are professionally and economically sustainable.

There are many different pathways to a sustainable future for risk advice, and in this paper, we draw on the insights, experience, and wisdom of five advisers and industry experts, with the aim of encouraging and guiding others who believe that protecting one’s wealth is every bit as important as growing it.

Risk advice – the 2024 context

The current context for life insurance advice is characterised by both demand side and supply side constraints.

Supply side – declining adviser numbers and remuneration caps

The contraction of adviser numbers has been well documented1, with the current 16,000 registered advisers representing a decrease of more than a third compared to just three years ago.

However, the combination of commission capping and new educational requirements has seen a disproportionately larger impact on the number of advisers actively recommending risk.

As reported in Professional Planner, there are just 150 risk specialist advisers and 949 that were “largely specialised” in providing risk advice. Another 2,372 provided “some” advice on life insurance2.

Figures from Professional Planner suggest the number providing any form of risk advice is actually larger, finding that 6,373 financial advisers wrote a risk policy in the first half of 2023. However, concentration is evident with fewer than 500 responsible for 50% of all new business3.

Demand side – underlying demand is strong

On the consumer side, there is every reason to believe the demand for advice generally, and risk advice specifically, is substantial.

Various studies have suggested anywhere from 25% to 40% (ASIC) of Australians intend to seek professional financial advice in the future4.

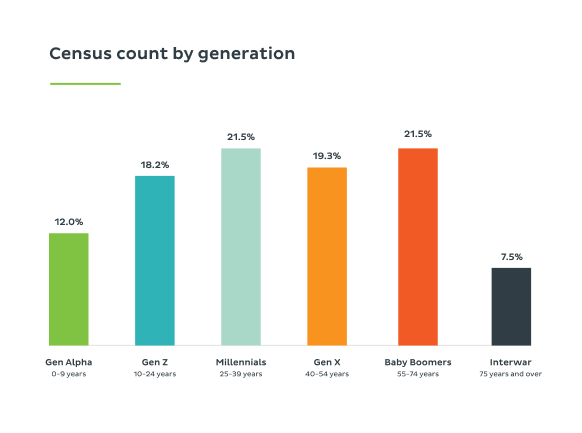

The drivers of life insurance needs are also resilient. Over 46% of Australians are aged 25 – 595, the ages when life insurance need tends to peak.

Mortgage debt continues to climb, and each year we see in the vicinity of 300,000 births6 and 100,000 marriages7, suggesting the need for cover – and by extension, the need for professional advice – remains strong.

According to Deloitte’s 2023 ‘Mind the gap’ research, Australians are underinsured by as much as 60-80%, leaving $25 billion in potential claims on the table8.

Figure 1: Australian population by generation (2021)

Affordability of life insurance advice is still an issue

A significant barrier exists, however, between consumer demand and their willingness to pay, for advice.

As reported by the AFR, this barrier remains an issue with estimates that around two-thirds (64%) of consumers were unwilling or unable to pay more than $500 for advice, well short of the $3,710 median mentioned10. Various previous studies suggest that, in relation to life insurance advice specifically, the appetite for fees is even lower.

Closing the risk advice gap

With consumer need and demand for life insurance advice remaining strong, and the cost of providing advice leaving it out of reach for many, action must be taken to ensure the advice and insurance coverage gap doesn’t evolve from social policy challenge to an economical disaster.

The key is to find ways that life insurance advice can be offered in a more sustainable way, making it more affordable while ensuring advisers are still able to provide advice in a way that is financially viable – at the time of delivery and over the long term. Loss-leading strategies are unlikely to be truly sustainable.

Adviser insights reveal different paths to sustainable, future-proof risk advice

For the purposes of this paper, we interviewed several advisers who are all actively providing life insurance advice, and are doing so in a way that is affordable to their clients, and profitable for them.

While they have all taken unique pathways to sustainability, there are several common, high-level themes that characterise these different pathways:

• A focus on efficiency

• An advice philosophy that sees life insurance as a foundational aspect of advice

• A financial/remuneration framework for risk advice that is profitable yet affordable to clients

Efficiency has been a key advice narrative for several years

Efficiency has been a key narrative in advice for many years, but particularly since FSC/KPMG research11 released in 2021 found that the average cost to deliver advice was almost 50% more than the average advice charged. In other words, initial advice was a loss-making proposition.

To the extent that compliance related red-tape is seen as a major contributor to the cost of providing advice, various representations have been made to the government on the potential impact reducing or removing this red tape could have on the cost of delivering advice.

Indeed, the FSC, with reference to a simple seven stage advice model, shown below, suggested several reforms to streamline advice, including changes relating to SOAs, disclosures and authorities, and safe harbour steps.

Figure 2: Seven stages of advice

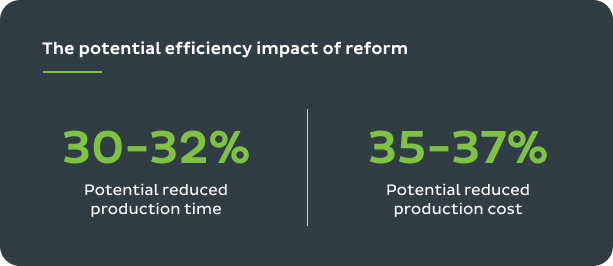

Quantifying the potential outcomes of QAR

At the time of preparing this report, the Federal Government had released its response to the QAR recommendations. This response included proposals to replace the SOA with a simpler record of advice, scrap safe harbour steps, as well as other disclosure and process simplifications.

To the extent many of the QAR recommendations are similar to the streamlining proposed by the FSC in their 2021 paper, the modelling done by KPMG for that paper may serve as a useful proxy for the efficiency savings that may be possible once the Government’s reforms become law.

According to KPMG, the streamlining originally suggested by the FSC had the potential to reduce the time taken to produce and deliver advice by 30% to 32% (around seven hours), with an associated reduction in cost to serve of around 35% to 37%.

Despite the risk advice process’s complexities and extra steps (underwriting, pre-assessments, etc.,) which may lower the potential magnitude of the efficiencies calculated by KPMG, these estimates are still a useful quantification of what may be possible.

While the replacement of SOAs and other changes may be a welcome boon for advisers, those interviewed for this paper weren’t passively waiting for legislative changes, but taking a more proactive approach to streamlining their business models and processes.

Efficiency can be driven in different ways

While efficiency can be driven in many different ways, several in particular are commonly used by advisers, in one guise or another:

• Specialisation

• Outsourcing

• Using innovative new technologies

SPECIALISATION

Specialisation as a driver of efficiency

None of the advisers interviewed for this paper were risk specialists in the traditional sense.

Surviving as a standalone risk specialist will remain challenging under a 60/20 commission regime unless you have the advantage of large scale, deal exclusively with clients paying high premiums, or have cracked the code of charging an advice fee to supplement commissions.

However, specialisation within a holistic practice, working in collaboration with other advisers to deliver a total advice solution, is increasingly common and is associated with significant efficiency benefits.

The concept is simple, the more a person repeats a task, the more they become familiar with it. Repetition over time makes them able to perform tasks faster, and more accurately.

There is extensive academic evidence demonstrating the degree to which specialisation can drive efficiency, of this effect, including studies suggesting that every time staff on an IT service desk doubled their problem-solving experience, problem-resolution times reduced by 6.7%12. Similar results have also been found across areas as diverse as banking and cardiothoracic surgery.

Expert Insight – with specialisation comes confidence and efficiency

“The more life insurance advice you deliver, the more familiar you become with what insurers look for and how they treat different health conditions. Over time this builds your knowledge and confidence, allowing you to do a form of field underwriting, which can be an enormous efficiency driver and means less surprises for the client.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

“To go through a whole process just to have a client declined is resource intensive, but can largely be avoided with some skilled field underwriting up-front. It’s a dying skill and I’d really like to see the insurers provide more support in building these skills with more advisers.” Chloe Arthur, Associate Partner, Risk Insurance, Findex

“Field underwriting is about thinking in terms of what data you can give the underwriter that will give them the confidence not to ask for an additional report? Knowing the answer to that, and benefiting from the associated time savings, comes with experience.” Marc Fabris, Founder, RiskHub

Benefits of having risk specialists within a holistic practice

In a life insurance-specific context, specialisation drives efficiencies in several ways:

- Life insurance products can be complex and highly technical. Stronger knowledge of product features and guidelines removes the need to seek technical support or analyse research ratings.

- Specialisation allows advisers to become more confident as field underwriters, and skilled at identifying potential challenges relating to client’s health. This allows advisers to set client expectations earlier in the process and avoid rework.

- Building relationships with underwriters, and understanding the underwriting philosophy and risk appetite of insurers in different scenarios, can reduce time spent on pre-assessments.

- Data previously published by Riskinfo13 showed how time-consuming some claims can be. 75% of claims took more than 11 hours to manage, and one in five claims took more than 30 hours. Understanding the claims process and requirements can significantly reduce this time.

Adviser Insight – specialisation takes pressure off advisers

“We needed to change our model to be efficient and scalable, in a way that doesn’t put as much pressure on an individual adviser to deliver such a wide scope of advice. For that reason, we are looking to have SMEs within the practice, including risk specialists. Because of the way we have simplified our end-to-end processes, the risk specialists will be able to produce an advice document within an hour, without the need to refer this scope of the advice to a paraplanner.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

Adviser Insight – specialisation allows advisers to move up the complexity curve

“By developing in-house specialist risk expertise, we’ve been able to move the dial on the sophistication of advice we provide, so we are now doing a lot more business insurance and succession planning, which can generate higher revenues.” Chloe Arthur, Associate Partner, Risk Insurance, Findex

OUTSOURCING AND OFFSHORING

Outsourcing is becoming increasingly popular among advice practices. Indeed, AdviserVoice recently reported that the average practice now has the equivalent of one outsourced staff member for every six internal team members14.

All the advisers we interviewed either already outsource, or are planning to outsource aspects of their advice business. In three-quarters of cases, the outsourced provider was offshore.

Functions commonly outsourced to third parties include specialised capabilities such as:

- Paraplanning

- Compliance

- Investment management

- Technology management

- Client administration

- Marketing

While cost reduction (allocating tasks to resources who can perform them more cheaply) is undoubtedly the main reason advisers outsource, there are other associated benefits, including:

- Freeing up the adviser to spend more time building and maintaining client relationships.

- Outsourced functions being performed to a higher standard, leading to better client outcomes and greater client satisfaction.

- Lower error rates and less rework.

Different types of outsourcing

In its purest sense, outsourcing simply means allocating to others, tasks that would otherwise be performed within a practice. In a broader sense, this can also include ‘outsourcing’ via automation, outsourcing tasks to life insurers, and even clients.

Outsourcing to external specialist resources

Over the last decade or so, practices have increasingly been outsourcing aspects of the advice value chain. As the trend away from large institutional licensees to smaller and boutique licensees continues, outsourcing is likely to become even more common, with smaller practices lacking the scale to employ specialised resources in-house.

Services outsourced include those that could be performed better by external resources such as investment management and marketing, and those that can be performed more cost effectively, including client service.

Paraplanning was one of the earliest functions to be outsourced, for capability and cost reasons. It was recognised early on that an adviser who could charge themselves out to clients at $300 or more an hour, shouldn’t be performing a task that could be outsourced for $100 an hour or less.

When it comes to client administration and other tasks that – theoretically – would fall within an adviser’s capability, this cost difference can be even starker.

The potential for cost savings is greatly amplified if the outsourced resources are offshore.

Labour cost differentials between Australia and the Philippines – where many of these providers are based – can be significant.

Indeed, in the experience of the advisers interviewed for this paper, the potential savings in labour costs by using offshore resources can range from 30% to as much as 70% of the cost of a domestic-based equivalent.

Adviser Insight – outsourcing allows us to operate more sustainably

“As advisers we need to be clear about the absolute best use of our time. Outsourcing creates the opportunity for more profit, which makes us a more sustainable business and means we can afford to look after our clients better.” Andrew Courtney, Principal Adviser, Director & Co-founder, Plenitude Wealth

Adviser Insight – outsourcing administration to a local business

“We outsource all our administration to a local Gold Coast business, run by one of our key team members who previously was employed in our practice a few years ago. They will contact the client directly where necessary, within the parameters we have set them. We’ve worked with them long enough to have developed a strong trust and we regard them as a valued part of our team.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

Early concerns with offshoring have largely dissipated

In the early days of outsourcing, many advisers had a range of concerns, especially outsourcing using offshore providers.

As a profession that has relationships at its core, the inability to be physically in a room with someone can, for some advisers, be an insurmountable barrier to relationship building. In this context, offshoring felt like a bridge too far for many. How can I trust them? How do I talk to them? What if something goes wrong?

One of the positive legacies of COVID was to accelerate the adoption of virtual and video communication for relationship-based service providers, including financial advice. As video meetings and working from home become commonplace, communicating with a resource via video has been normalised, and geography is not perceived as the barrier it once was.

Other concerns revolved around perceived data security risks, the challenges of operating in differing legal jurisdictions, and governance concerns more broadly.

In reality, many of these concerns are no longer valid.

Adviser Insight – offshore teams can provide a broad range of support

“Our Philippines team prepares quotes and scenario comparisons. They do all the policy implementation, including emailing clients throughout the process.” Andrew Courtney, Principal Adviser, Director & Co-founder, Plenitude Wealth

“We have a team of six offshore, doing everything including onboarding, paraplanning, implementation and ongoing client administration. We provide communication templates to ensure quality consistency, and to make sure everything sent out from our offshore team is in our tone of voice.” Trish Gregory, Certified Financial Planner, Fox and Hare Financial Advice

“We are about to offshore our renewals process. It’s some fairly easy data entry but on a large scale, so it was an obvious candidate for outsourcing.” Chloe Arthur, Associate Partner, Risk Insurance, Findex

Many offshore providers have world-class governance

Offshore service providers now offer high levels of service and robust governance.

Many of the larger providers of offshoring services to Australian advisers are Philippines based, but were founded and still managed by Australian advice experts. As such, their governance frameworks and service standards are often far higher than many small Australian-based advice practices would be capable of.

One such player is VBP, who summed up their approach to data security and governance in this way:

“VBP prioritises data security by implementing robust measures that safeguard sensitive client information. We have comprehensive data governance frameworks, employ stringent access controls, and deploy advanced encryption techniques to protect data. We are certified against the ISO27001 standard and ensure customer data is stored in Australia. Additionally, we conduct regular security audits and educate employees on data privacy best practices to foster a culture of security awareness.

VBP has invested heavily in best practice governance, and recently earned its BCorp certification, a designation that a business is meeting high standards of verified performance, accountability, and transparency on factors from employee benefits and charitable giving to supply chain practices and input materials.” Shaun Nesbitt, Chief Information and Digital Officer, VBP

Adviser Insight – leading an offshore team is just like leading a work-from-home team

“I just think about our offshore team as working from home. Home just happens to be overseas. But you still need to manage, lead, and engage, as you would with a local team. You aren’t outsourcing your need to lead or provide direction.” Andrew Courtney, Principal Adviser, Director & Co-founder, Plenitude Wealth

Adviser Insight – outsourcing is about us better matching skills with tasks

“Our approach to outsourcing is no different to our approach with allocating work in-house, it is always about matching the right skill set to the right tasks. It doesn’t make any sense to utilise scarce and valuable client-facing resources on data entry”. Chloe Arthur, Associate Partner, Risk Insurance, Findex

Expert Insight – effective outsourcing requires sorting out underlying processes first

“I see a lot of practices offshoring, but not all are doing it efficiently. You have to get your underlying processes right for offshoring to give you a meaningful financial advantage. Getting your processes sorted also makes it easier for outsourced providers to accommodate your needs, and also makes it easier to move providers down the track.” Marc Fabris, Founder, RiskHub

Specialist outsourcing agencies

While some advisers choose to deal directly with offshore providers, for smaller practices, the logistical challenges associated with selecting and managing an outsourced provider can be problematic. For this reason, some choose to work with locally based outsource managers, who can support advisers throughout the process, effectively acting as the intermediary between the outsourced service provider and the adviser. While this can provide peace of mind and take a weight off an adviser’s shoulders, it comes at a cost.

Digital technology innovation – driving efficiencies, improving the client experience

Technology continues to reshape financial advice, with its ability to speed up tasks, drive down costs, and provide a more seamless client experience.

Clients want to engage digitally

The digitalisation mega-trend has changed the way clients interact with products and brands. As consumers, we are empowered to research, compare, and ultimately buy everything from groceries to cars via digital channels.

For businesses, this is a double-edged sword. While digital channels are cheaper to support, consumer expectations about turnaround times, service standards and the quality of the mobile experience are increasing every day, and financial services brands are being compared not with other insurers or financial advisers, but with other categories such as retail.

This is especially true for younger clients – prime life insurance buyers. According to a recent survey of Australian millennials by Swiss Re15, more than half of the surveyed group prefered online transactions for insurance purchases, compared to 19% favouring purchases through superannuation and 17% seeking a mix of independent research and professional advice. The preference for online channels isn’t about anti-advice sentiment, it’s about convenience and responsiveness.

In other words, your external digital game must be strong.

Adviser Insight – younger clients demand digital engagement channels

“We work almost exclusively with Gen Z and millennial clients, and technology is critical, not just as a way of serving younger clients profitably, but because digital engagement is central in their lives.” Trish Gregory, Certified Financial Planner, Fox and Hare Financial Advice

Technology and digital innovation as efficiency drivers

The cost to serve in advice has been in the spotlight for some time now, and driving it down is central to making advice more accessible to consumers, and more sustainable for advisers. In this regard, the role of technology in driving down costs across the advice value chain has been a central narrative.

There are many aspects of the advice value chain that are ripe for automation, including:

• Appointment booking

• Client fact finds

• Client reviews

• Revenue management

• Compliance (via RegTech)

• Service personalisation

Breaking down the initial production of advice into smaller steps, we can see even more scope for automation, including SOA generation, research and risk profiling.

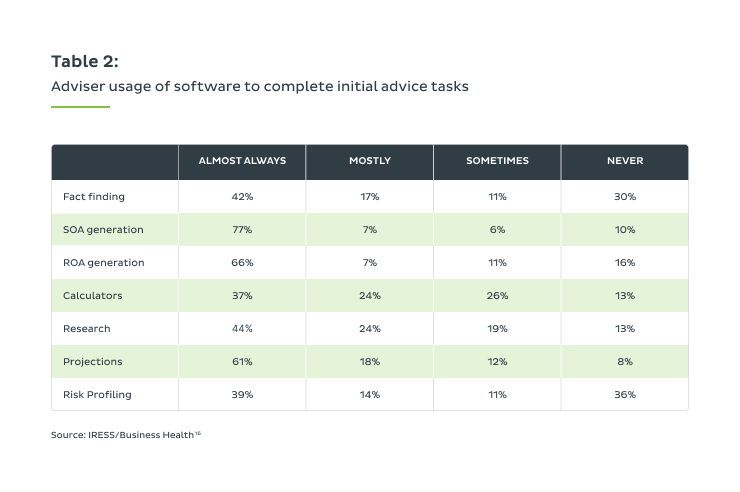

While the advisers we spoke to are all advocates of using technology to drive efficiencies and customer experience, recent research by IRESS and Business Health16 showed – in some parts of the process at least – advisers are leaving many efficiency opportunities on the table.

Only around 40% of advisers are using online fact finds most of the time, and one-quarter of advisers still haven’t fully automated their SOA generation process.

Estimates vary, but typical figures suggest the use of online fact finds alone can save advisers 1.5 hours per client, and in conjunction with other digital tools, a saving of 5.5 to six hours per client across the advice process is possible. Advisers making those savings can decide whether to take them as higher margins or pass them onto clients in the form of lower fees.

The advice technology space sees constant innovation, opening up new opportunities to automate tasks in a way that not only drives cost savings but also more consistency, quality and accuracy of execution.

Smaller and boutique practices have a unique opportunity to build their own technology stack, no longer forced to use software and hardware stipulated by their institutional owners. As a result, the broader market is embracing new solutions, and the Ensombl platform sees a lot of discussion about technology integrations.

Expert Insight – workflow and task management technology is popular

“As well as advice-specific technology, many of the most successful advisers are applying tech to their general ways of working, and in bringing meetings to life, including the increasing number of AI tools available through online meeting platforms. Technology I see in many practices includes Jotform and Typeform for online form building, and task and management/collaboration tools like Trello and Click-up.” Marc Fabris, Founder, RiskHub

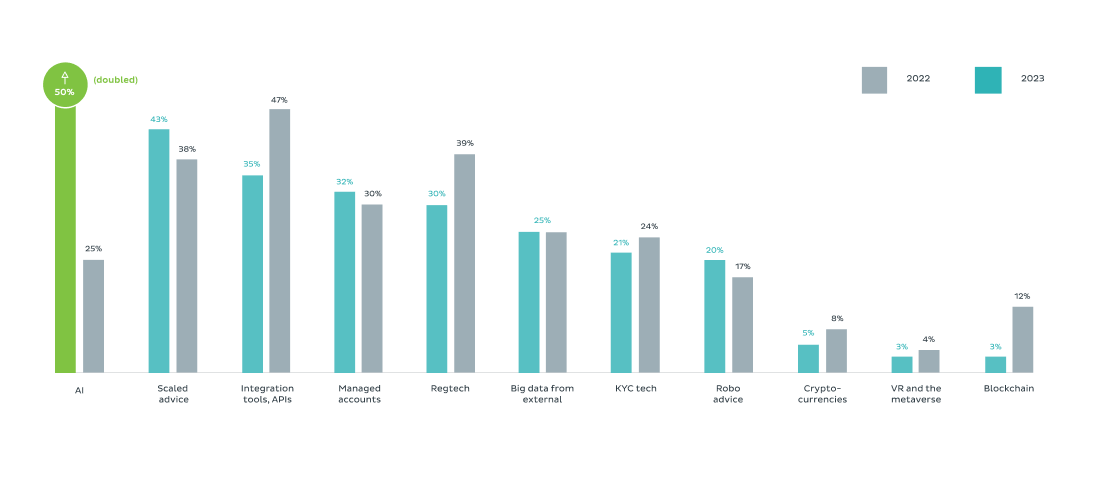

AI will create new possibilities for advice practices

Further innovation in the AdviceTech space is assured, with Artificial Intelligence, in particular, likely to revolutionise advice practices. Netwealth’s 2023 AdviceTech report18 found that AI was the technology advisers expected by advisers to have the most impact on their business over the next five years.

Adviser Insight – using AI to craft client communications and social posts

“I have started using ChatGPT to draft my marketing and social media posts. There may be questions of its accuracy when used for research, but when it comes to drafting and summarising much longer content for use across social platforms or in client emails, it is a brilliant timesaver, and a better writer than many people I know.” Andrew Courtney, Principal Adviser, Director & Co-founder, Plenitude Wealth

Figure 2: technology advisers expect will impact advice the most over the next 5 years

Source: Netwealth18

Risk specific technologies

Aside from risk research tools, the advisers interviewed were not using any risk specific advice software.

They all mentioned their enthusiasm for more automation in the two biggest pain-points within the risk advice process – pre-assessments and in-force amendments.

The idea of a fully automated and standardised pre-assessment process – where information could be submitted once, in a standard format that was accepted by all insurers – was cautiously welcomed for its efficiency potential, although it was noted that building relationships with individual underwriters was still critical.

Adviser Insight – tech-driven efficiencies are key to keeping fees affordable

“We use Adviser Logic, with customised fields and workflows. It’s excellent with risk research too. The way we have designed our processes means risk research can be done in 5 to 10 minutes. We can do research, pre-assessment, talk to an underwriter and proceed to quote in around 90 minutes tops, which really helps alleviate pressure on costs meaning we can keep our fees affordable.”Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

“We are 100% virtual meetings only. We use Adviser Logic for our CRM and for advice documents. We use Hubspot for our lead management, and, because the entire office works remotely, we use Sharepoint for document sharing.” Trish Gregory, Certified Financial Planner, Fox and Hare Financial Advice

“We have chosen our tech stack to allow us to be as efficient as possible. Our systems include Plutosoft and Docusign on the advice side, and Slack and Asana for our workflow and project management and team engagement. Around 90% of our client meetings are via Zoom. We also use Grammarly to ensure the quality of our written communication, which is handy with our offshore team.” Andrew Courtney, Principal Adviser, Director & Co-founder, Plenitude Wealth

In-force amendments – a process ripe for digitalisation

The cost-of-living challenges currently faced by many households – especially those with mortgages – have seen a dramatic increase in the volume of in-force amendments, with many policyholders thankfully preferring to (temporarily) reduce their sum insured rather than cancel their cover altogether.

In-force amendments were universally seen as the biggest pain point within the risk customer lifecycle, almost always involving manual, rather than automated, processes.

It was recognised that the streamlining of this process was a priority for most, if not all, insurers, with the potential improvements in both efficiency and client experience likely to be significant.

“Most advisers I speak to say reviews are extremely challenging from an effort and resourcing perspective. Some of the obvious opportunities here include automating client communications to flag those clients who have had meaningful changes in circumstances. Hand in hand with a more streamlined in-force amendment process, that could be a game changer for advisers, and for better client outcomes.” Marc Fabris, Founder, RiskHub

Redesigning process allows bigger gains from technology

Automating a bad process still leaves you with a bad process, which is why prior to embracing automation, advisers and practice owners should revisit and objectively assess existing processes to identify opportunities to streamline, or even cut out processes altogether.

Areas to investigate include document production, obtaining client signatures and authorities, fact-finding (including health details), and reviews.

The trait shared by all advisers participating in this research was the preference to gather as much health information as early as possible in the process, to help narrow down insurer selection and set expectations with the client about further information likely to be requested, and the possibility of non-standard terms.

Adviser Insight

“By taking a modular approach to advice, we are able to streamline the SOA for each module, all of which rolls up to a much shorter and simpler set of advice documents in total, and a much simpler SOA for the risk module specifically.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

“Our process is to get as much information as early as possible, before we even go to a fact find, and we’ve got a data collection tool we use for that. If they are already a client of a different part of the practice, such as accounting, we draw in any relevant data we already have on file.” Chloe Arthur, Associate Partner, Risk Insurance, Findex

Technology allows you to share the workload with your clients

Giving clients a more active role in the risk advice process has two important benefits:

• It creates more involvement in, understanding of, and engagement with the advice process

• It reduces the workload of the adviser.

The concept of ‘giving clients homework’ is understandably popular with many advisers, especially in the early stages of advice.

Having clients complete their own online fact finds – and requiring it be completed before an appointment can proceed – can create massive efficiencies, by reducing the time spent by the adviser on this process, reducing the incidence of unproductive meetings because the client is unprepared, and in helping the adviser target their follow up.

Three of the four advisers interviewed used a true online fact find process.

Online appointment booking systems, where clients can choose from available time slots, is another common example of having the clients do some of the work themselves.

“We get our members to do an online fact find through My Prosperity. As part of that process we also get them to upload documents, link accounts and so on, so the time we spend with them can be truly focused on them and their needs, rather than paperwork. We also get them to complete a reasonably comprehensive health declaration, which helps us focus the life insurance process and contains enough detail to get high-level underwriting guidance.” Trish Gregory, Certified Financial Planner, Fox and Hare Financial Advice “In terms of the health information we require our clients to provide before we even have that first meeting, we actually tell our clients we won’t proceed without it. It’s proved very effective at ensuring their commitment and driving a quicker turnaround.” Chloe Arthur, Associate Partner, Risk Insurance, Findex

Expert Insight

“We did some research last year and found only one in seven advisers were getting detailed health information before the first client meeting. That means six out of seven are starting from scratch in the first meeting, with no opportunity to do some preliminary pre-assessment. It is also costing the adviser $300 an hour to perform a task that could be outsourced for $30 per hour.” Marc Fabris, Founder, RiskHub

Video meetings

Video meetings can be seen as a form of outsourcing to clients, as you are effectively making their home the meeting venue. Aside from the potentially significant savings from not maintaining a large office space with meeting facilities, video meetings have both efficiency and client experience benefits.

For the adviser:

- More meetings can be held in a day

- Less meetings get cancelled because of sick children or bad weather or start late because of bad traffic

- The client is generally more relaxed and open because they are in their own environment

- Clients have immediate access to any information the adviser might need

For the clients:

- The meetings are less stressful as they don’t have to worry about what to wear, what route to take, where to park, what information they need to take

- They are in the comfort of their own home

Three of the four advisers we spoke to use virtual meetings almost exclusively. One offers in-person meetings but at an extra cost to the client. One also provides a summary of the SOA presentation in video form.

Three of the four effectively operate as virtual practices.

Adviser Insight – virtual meetings preferred by many

“90% of our client meetings are virtual, which frees up so much time in the day. We charge new clients extra if they want to meet us for the first time face-to-face.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

“We are 100% virtual. COVID proved to us that virtual meetings can be just as effective for relationship building as face-to-face, provided they are done the right way”. Trish Gregory, Certified Financial Planner, Fox and Hare Financial Advice

“We are probably at about 50/50 in terms of virtual and face-to-face meetings”. Chloe Arthur, Associate Partner, Risk Insurance, Findex

Tele-underwriting

Outsourcing the completion of the personal statement via ‘tele-underwriting’ comes with both efficiency and compliance benefits (for example, the risk of non-disclosure). Some advisers however still prefer to undertake this process with their clients, viewing it as an important value add, and a key opportunity to build client rapport and trust.

Adviser Insight – set client expectations when using tele-underwriting

“We work with busy professionals so tele-underwriting works well from a convenience perspective. But discussing your medical history with someone at the end of a phone can be a little daunting for some, so I always have a standalone session with the client on what to expect, so they aren’t surprised and are more relaxed.” Trish Gregory, Certified Financial Planner, Fox and Hare Financial Advice

“We rely on tele-underwriting, but I always work with the clients beforehand to help them to understand what the process is about, and how it will run, so they feel more confident and in control.” Andrew Courtney, Principal Adviser, Director & Co-founder, Plenitude Wealth

Expert Insight

“Hopefully a market level solution that standardises the pre-assessment process across all insurers isn’t far away. In the meantime, I think many advisers have scope to improve the quality of the information they send to insurers. The more forward-thinking advisers have already collaborated with the different insurers on what this could look like.”Marc Fabris, Founder, RiskHub

Hybrid advice – the future?

There has been a widely held assumption that the consumer preference for digital engagement with financial services providers would pave the way for robo-advice to become a dominant force. However, this has not proved to be the case, with evidence suggesting consumers still prefer some degree of human interaction.

In Australia, research by Investment Trends19 found that two in three Australians were open to using a digital advice tool to plug advice gaps, but ‘most would prefer to use in conjunction with some form of human interaction’, while a study by Griffith University researchers, Man and Machine20, found that consumers had little faith in investment advice involving amounts over $1,000.

Increasingly, it is becoming clear that hybrid digital advice – a combination of digital and in-person advice – is likely to be the way of the future, with advisers incorporating elements of digital advice into their offering. This would make it more economical to provide advice, especially for lower value and simpler advice cases, as well as providing a more contemporary (i.e., digital) customer experience.

In late 2022, global banking giant, JPMorgan, noted that pure digital financial advice was starting to lose traction in the United States as consumers warm to a hybrid advice model coupling human advisers with digital capabilities21.

Nick Eatock, CEO of UK digital advice platform, Intelliflo, told the Australian Financial Review that global momentum was shifting to a hybrid format.

“That hybrid-type approach is the winner, we think, of the investments that have been made in robo-advice. That’s the next step forward, and we’re seeing that certainly in the UK and US already.”22

Digital solutions to support a hybrid approach

There are already many established solutions in the local market that can support them to develop their own hybrid offering. One 2023 industry report23 identified 16 solutions, with more likely to enter the market as it becomes more established.

The capabilities of these solutions vary, with some able to offer client engagement support only, some limited to general advice, and others providing comprehensive personal advice.

Solutions that are comprehensive advice capable include, but are not limited to, Intelliflo, Dash, Capital Preferences, Ignition and Money GPS.

More client ‘face time’ drives higher revenue

The opportunity cost of an adviser performing tasks themselves that could be outsourced or automated is not simply lost revenue, it is lost time that could be spent engaging with existing clients.

Australian research by VBP24 showed a positive correlation between adviser ‘face time’ and income, with the highest-earning advisers spending over half their time in client meetings, and around a third on business development (and just 4% on investment management).

Advice philosophies – life insurance as a foundational component of advice

All the advisers interviewed agreed that advising clients about life insurance was something they did not just to satisfy FASEA’s requirement to explore the totality of a client’s situation, but because they philosophically and fundamentally believed in the foundational role of life insurance in protecting wealth.

While the advisers interviewed worked with a range of different client segments, from ‘mums and dads’, through to millennials, high-net-worth, and small business owners, all believed in offering their clients advice all along the spectrum, from cash flow and budgeting, through risk management, investing, tax planning, and estate planning.

Adviser Insight – protecting wealth is every bit as important as growing it

“The experiences of those close to me have given me a fundamental belief in the importance of protecting your wealth and your income, and that manifests as a commitment to ensuring my clients are protected also.” Trish Gregory, Certified Financial Planner, Fox and Hare Financial Advice

“Better technology alone isn’t the key to writing more risk, you have to believe in it philosophically. We don’t see risk only clients, and nor do we give clients a wealth plan without life insurance. We see life cover as fundamental to protecting wealth, as an asset that prevents wealth being eroded because of ill health, or worse.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

A holistic approach may be more futureproof

Regulatory considerations aside, a more holistic approach to advice – which includes risk management – is likely to prove more resilient to future market disruption.

Cash flow and life insurance advice are often seen as entry points to advice, and will enable advisers to attract younger clients, including the adult children of existing clients.

Comprehensive estate planning is a critical aspect of intergenerational wealth transfer. This multi-trillion-dollar wealth transfer is already underway, and those advisers who don’t engage with younger generations within a client family are at risk of losing significant funds under management.

Indeed, according to the 2022 Schroders UK Financial Adviser Survey25, the majority (59%) of advisers are concerned they could lose their businesses as wealth transfers between generations, due in part to the tendency for inheritors to discard their parents’ adviser, estimated by some to occur in around 70% of cases.

Offering cash flow and life insurance advice at one end of the advice spectrum, and estate planning at the other, allows advisers to engage with the children of older clients, helping mitigate the risk of FUM loss due to adviser change.

Adviser Insight – transition to holistic approach driven by client needs

“We started as a commission-only risk specialist but transitioned to a fee-for-service holistic advice practice. We didn’t make the transition because of LIF, we just wanted to make the full spectrum of advice affordable and accessible to everyday Australians.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

A futureproof remuneration framework

Offering life insurance advice within the context of holistic advice comes with three significant advantages from a remuneration perspective:

- Clients are likely to be more accepting of paying a fee for advice.

- Advisers aren’t reliant on commissions, giving them more flexibility in how they charge their clients.

- Remuneration can be decoupled from the successful acceptance of risk by the insurer, meaning advisers aren’t out of pocket if a client is declined by all insurers.

Adviser Insight

“We only offer holistic advice, and life insurance is a part of that. We charge a fee that makes us profitable before any commissions are received. We aren’t reliant on clients taking our cover, and we aren’t financially exposed in the event their application is declined.” Andrew Courtney, Principal Adviser, Director & Co-founder, Plenitude Wealth

As much as client reluctance to pay for advice is a current reality, many believe this will change over time, as the professional reputation of advisers improves, and younger clients, who recognise the value of expert help, come into the advice ecosystem. The current complexities of managing cash flow and investing during times of high inflation and market volatility may well see this trend develop sooner rather than later.

In mid-2023, Professional planner reported clients were willing to pay up to $5,000 for advice26, finding more than one in five consumers surveyed said they were both equipped and prepared to pay between $2,500 and $5,000 for advice. Among the possible explanations for this spike was the increasingly complex financial environment.

Adviser Insight- knowing your cost to serve is critical

“I was taught early on the importance of understanding your cost to serve, in order to ensure your fees are set at the right level. We review our cost to serve every six months, and ensure we understand how it varies by client type.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

Thinking outside the square with advice fees

Advisers have demonstrated innovation and flexibility in risk advice fees, especially within a holistic advice framework.

Examples evident from the advisers we spoke to include:

- Having a portion of their fees paid by the client’s superannuation fund(s).

- Arranging payment plans so fees could be paid in instalments over several weeks or even months.

Claims management fees

Another concept gaining traction is the idea of charging a fee for managing life insurance claims. To do this you may need to have an AFSL authorisation for claims handling, however it is something we are seeing gain traction.

Traditionally, many advisers have held the view that renewal commissions cover the cost of any claims management. While this view is still prevalent, the idea of charging a fee for complex claims management is starting to gain traction, predicated on the belief that claims can be extremely time consuming to manage properly, and that clients would happily pay a fee if it was deducted from the proceeds of a successful claim (so they weren’t out of pocket).

Two of the advisers we spoke to have adopted such an approach, either with their own clients, or as a standalone service to non-clients claiming against their group life cover.

“Our FSG allows for a claims management fee.” Andrew Courtney, Principal Adviser, Director & Co-founder, Plenitude Wealth“The financial planning benefit available for many lump sum claims often gets overlooked, but it can be an important enabler of post-claims advice. We also offer a group life claims service for non-clients who require specialist assistance, and charge by the hour.” Jodie Douglas, Principal Financial Adviser & Managing Director, Mad About Life

Ultimately, a sustainable future for risk advice isn’t simply about efficiency

For all the innovative ideas and different approaches to business models, technology, remuneration frameworks and resourcing, these factors can be seen as lower-order enablers of a sustainable future for risk advice.

At its core, risk advice – more than any other aspect of advice – relies on relationships. The relationships between the adviser and the insurer, the adviser and the underwriter, and the adviser and claims manager, will do more to drive success within risk advice than a process that is ultra-low cost but lacks the human element.

The two sides need to work hand in hand.

Advisers who fundamentally believe in the importance of protecting wealth as part of the advice proposition, who can employ best practices in the design and resourcing of their business, and who are committed to building deep connections with their clients, will always be able to create a sustainable future for life insurance advice within their practice.

Expert Insight – comprehensive support makes it easy to take first steps in risk

“I know some advisers who aren’t active in risk might feel they are too far behind the game to even start. But it’s not true, it’s not too late. And the support insurers can provide these days, through their online academies and guides and webinars and so on, is just first class, and can help even the newest advisers take their first steps towards protecting client wealth.” Marc Fabris, Founder, RiskHub

Summary

In recent years, life insurance, or risk, advice has undergone significant change. In line with the recommendations of the QAR, the Government has given a tick of approval to the continuation of life insurance commissions, offering a degree of certainty to advisers. However, the level of commissions remains a barrier to some advisers operating sustainably in this space.

A new crop of advisers is taking a fresh perspective on risk advice, taking innovative approaches to incorporate risk into their advice proposition in a professional and economically sustainable way.

While there are many different pathways to this sustainable future for risk advice, there are several common, high-level themes that characterise them:

- Efficiency, driven by strategic outsourcing, process optimisation

- The adoption of innovative digital technologies that can drive efficiencies and improved client experience

- An advice philosophy that sees life insurance as a foundational aspect of advice, and

- A financial/remuneration framework for risk advice that is profitable yet affordable.

Important information

This information has been prepared for use by licensed advisers in their professional capacity. Any advice is general in nature only and does not include legal, product or tax advice. While TAL Life Limited (ABN 70 050 109 450 AFSL 237 848 TAL Life), part of the TAL Dai-ichi Life Australia Pty Limited (ABN 97 150 070 483 group of companies TAL), has sponsored this paper, this content has been prepared solely by Ensombl. Unless stated otherwise, all opinions expressed in this paper are the opinions of Ensombl. The views expressed in this document by persons who are not representatives of TAL are their own, and do not necessarily represent TAL views.

References

2. https://www.professionalplanner.com.au/2023/09/risk-advice-stalwarts-lament-integrity-life-exit/

3. https://www.professionalplanner.com.au/2023/12/declining-profitability-and-the-woes-of-risk-advice/

4. https://download.asic.gov.au/media/5243978/rep627-published-26-august-2019.pdf

5. https://profile.id.com.au/australia/five-year-age-groups

6. https://www.abs.gov.au/statistics/people/population/births-australia/latest-release

7. https://www.abs.gov.au/media-centre/media-releases/weddings-bells-ring-out-again-2022

8. https://www.deloitte.com/au/en/Industries/financial-services/analysis/mind-gap.html

12. https://onlinelibrary.wiley.com/doi/full/10.1111/poms.13145

13. https://riskinfo.com.au/news/2020/11/24/poll-results-the-value-of-claims-services/

16. https://www.iress.com/media/documents/Advice_Efficiency_Survey_2023.pdf

17.https://www.iress.com/media/documents/Advice_Efficiency_Survey_2023.pdf

18. https://www.netwealth.com.au/web/insights/netwealth-2023-advicetech/#download

20. https://news.griffith.edu.au/2022/10/11/artificial-intelligence-not-trusted-for-financial-advice/

25. https://www.smsfadviser.com/news/22033-why-advisers-fear-intergenerational-wealth-transfers

26. https://www.professionalplanner.com.au/2023/07/advice-fees-stabilise-amid-political-noise-on-cost/

27. https://www.adviserratings.com.au/news/why-more-australians-say-they-ll-spend-big-on-advice/