From Adviser to Philosopher

How to unearth, enunciate and implement an Investment Philosophy in your Advice Practice

In this special production

Foreword

The Ensombl community has become known for its openness and collaboration, and the development of this piece has proven no different.

Each adviser is at a different stage in their investment expertise journey. And it is only through the sharing of your journey and discussing them in a safe space with your peers that you can each better organise your point of view and put that knowledge into action with your clients.

The advisers interviewed for this piece were both generous with their time, and transparent about their views and processes, and we wish to thank them for being such active participants in the positive evolution of financial advice:

Introduction

Everyone has a philosophy. No matter who you are, where you live, or work, we each have underlying philosophies for life that are reflected in how we live it. And for the lucky ones who are passionate about the work they do, you’ll also have philosophies about your area of expertise.

However, most people won’t have taken the time to reflect on their philosophy well enough to be able to clearly enunciate it to others. And for advisers, your investment philosophy is no different.

But why would taking that time be beneficial to an adviser and their advice practice? If you’re already operating under an investment philosophy, albeit an undocumented one, why take the next step?

Well, a clear, well defined and clearly communicated investment philosophy gives you the guidelines and boundaries that keep you on track as an adviser, guiding and driving all your decisions and subsequent actions on behalf of your clients.

Not only does this ensure consistency in your work between clients, it also reduces repetition in your thought process, with the majority of your time then made available to educate and engage with each client rather than reconsidering your approach from scratch in response to each investment conversation or decision. And it can even attract like-minded clients to you, as who you are, and what you’re about, is so clearly communicated.

Even beyond this immediate value, the critical thinking required to develop and nurture an investment philosophy over time, refines your information absorption and analysis skills (otherwise known as research) and ultimately enhances your problem-solving ability.

And this is what will be required of advisers now living in an era of exponential change – the ability to absorb new concepts, measure them against your core beliefs and then make decisions on what this means for your clients.

Past performance is not indicative of future results.

And past industries, markets and investment opportunities will change significantly into the future. However, with a well thought out investment philosophy, advisers will have a guiding light and framework to navigate both themselves and their clients through inevitable change.

Investment Philosophy or Investment Methodology – which one is for me?

When you start looking into all the different discussions around how you determine where to invest your client’s money you discover there are several expressions used. Investment philosophy, methodology, style and even investment approach.

And it can be unclear whether they are all talking about the same thing. Are they just referring to whether advisers are active or passive investors? Or is there something deeper, something underlying the way you choose to invest you should focus on? And how does this relate to what funds or stocks you should pick?

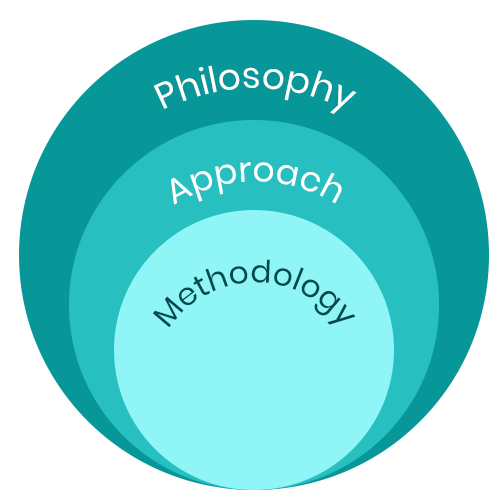

The answer is all of the above. All of these considerations sit under the overarching concept of a philosophy as follows1:

• Philosophy – a system of core beliefs that provide a frame of reference on a topic

• Approach – influenced by the philosophy, the approach has narrowed down how to deal with the topic, and often falls into one of the well-known categories or schools of thought on it

• Methodology – this applies the Approach by providing methods and tools to be used in practice

A simplified example of this for investments could be:

• Philosophy – we believe that markets are not always efficient, the world is continually changing, and every investor has a variety of goals which may each require a different approach

• Investment Approach – Dynamic Asset Allocation

• Methodology – utilising Managed Accounts provided by XYZ Investment Consulting

As you can see, the Investment Philosophy is more about abstract concepts and general attitudes while the Investment Methodology covers the practicality of implementing those concepts, with the Investment Approach being a way to link reflection to action. In fact, the Approach is often merely a label applied to shortcut a peer’s understanding of our overall philosophy, whereas the core beliefs within the overall philosophy are what anchor your client’s understanding of how their money is invested using the Methodology.

This may initially seem like splitting hairs, however by distinguishing between the three elements of the Philosophy, you are able to separate the parts likely to never change, being your core beliefs, from a methodology that is likely to evolve with changes in technology, improved efficiencies and shifts in requests from your client base.

PART 1: UNEARTHING YOUR INVESTMENT PHILOSOPHY

Getting Philosophical

Not surprisingly, the first step to developing an Investment Philosophy is to draw out your core beliefs. These are your most central ideas about investment and investing, and act as a lens through which every situation and investing experience is seen.

And with decades of experience, and having seen multiple market cycles, some advisers have absolute clarity about the underlying themes or key factors they see running through investment markets and the way they choose to invest.

But even for seasoned advisers, because these beliefs sit underneath their automatic reaction to situations, if asked to describe their core investment beliefs in 25 words or less, they would be stumped.

We are therefore going to go through a series of activities to help draw these out. You can grab the first activity and second activity downloads for this section in the Schroders space on Ensombl.

But what if I’m drawing a blank?

Some people have never had to dig down to unearth the “truth” about something, the unequivocal beliefs they have within a particular topic. And so these types of exercises can draw a complete blank.

Or, perhaps you’re newer to investments and providing investment advice, and don’t have the history or experience to draw upon to identify your core beliefs about investing.

This is where you need to draw on other people’s experience.

No matter the area of expertise you are looking to obtain, it is possible to fast-track experience through examining other people’s insights and stories. And they’re available out there, on tap for you to devour. Whether you prefer reading or listening, there are books, white papers, blogs and podcasts that all provide a different lens on investing.

In fact, almost all the advisers we spoke to as part of developing this piece could immediately pinpoint a book or podcast they felt influenced their philosophy. And the most passionate of them even re-read or re-listen to those same conversations every year or so.

To get you started, we’ve collated a list of books and podcasts below recommended by investment advisers, and from within the Schroders team, that helped form their views on markets or their investment approach.

Fooled by Randomness | The Hidden Role of Chance in Life & in Markets

Fooled by Randomness | The Hidden Role of Chance in Life & in Markets

By Nassim Nicholad Taleb

Suggested by Simon Doyle, Schroder’s CIO & Head of Multi Asset

Simon’s key insight: “That we overestimate skill and underestimate the role of luck (or randomness) in the outcomes achieved.”

More Money than God By Sebastian Mallaby

Suggested by Tyson Jonas, Jonas Wealth Management

Tyson’s key insight: “How these guys made so much money for clients and in really inefficient markets, but almost all of them have had huge losses at some point on the short side.”

We Study Billionaires On the Investors Podcast Network

Suggested by Kellie Wood, Schroder’s Deputy Head of Fixed Income Australia

Kellie’s key insight: “Talks to billionaires about how to succeed in markets and life, as I love success stories and learning about their different investment strategies.”

The Psychology of Money By Morgan Housel

Suggested by Brendon Vade, Lorica Partners

Brendon’s key insight: “This is one of the best articulations of the behavioural side of investing and money I’ve seen.”

Against the Gods By Peter Bernstein

Suggested by Stuart Dear, Schroder’s Head of Fixed Income Australia

Stuart’s key insight: “It’s an entertaining history of probability and risk that is useful information for anyone involved with markets.”

Boomerang | Travels in the Third World By Michael Lewis

Suggested by Peita Diamantidis, Caboodle Financial Services

Peita’s key insight: “By the writer of The Big Short and Moneyball, this dives into the human stories from around the globe of the “bubbles” that occurred in markets leading up to the GFC. In the end, it’s either about fear … or greed.”

As you absorb new content like this, it is important to take the time to reflect afterwards:

• Did it reinforce a view you already held?

• Or perhaps it contradicted or even challenged one of your long held investment beliefs?

• Did it crystalise for you what one of your investment beliefs might be?

Just like when we see a movie that really resonates with us, we gain even more from the experience by debating it with our peers immediately afterwards.

Activity

Activity

Consider starting up an Investment Book Club with some fellow advisers. Set a cycle of getting together, perhaps monthly to discuss your key takeaways from the book. And then at the end of each catchup, select the next book you will all commit to reading before the next get together.

What you’re looking for here once again, are ideas or themes you refer back to in every case. What underlying truths does each book reveal to you? Be sure to note them down as you go. And if you don’t have a group of advisers you could bring together in your own Investment Book Club, then head in here to the Schroders Investment Education space on Ensombl to connect with other advisers who are also interested in improving their investment knowledge.

Look back at your own “stories”

Once you’ve begun seeing investments through other people’s experiences and stories, it can then be powerful to look back at the key career stages, milestones or even lessons in your past. Because we aren’t born with a philosophy, we learn it through our experiences.

Activity

Activity

Start with your first job, or encounter with investments. What did you learn? What worked? What didn’t work? Then take steps forward in time and try to identify key milestones, events, or memories you’ve taken away from each key stage.

Write down what happened in each case, and what lesson you may have learnt.

Do some key themes or beliefs start to present themselves? Be sure to continually ask yourself, “But why was that what I learnt? What underlying belief am I forming here?”

Having undertaken all of this self-reflection you will hopefully be building a list of closely held investment beliefs. What you believe works in markets, what doesn’t work, and why you believe what you believe in. And of course, these will differ for each adviser, based on their own life and investing experiences. However there is generally one consistent position each adviser takes as part of their Investment Philosophy.

Are markets efficient or inefficient?

This is where you form a view on how markets behave, and how well they process information. Your opinion on this then feeds into whether you believe it is possible to outperform the market by stock picking or market timing.

In 1970, Eugene Fama, a University of Chicago Professor, who would later be awarded the Nobel Memorial Prize in Economic Sciences, published “Efficient Capital Markets: A Review of Theory and Empirical Work” which was the beginning of the efficient market hypothesis.

There are various responses to this theory, from absolute faith that all information, both public and private is incorporated into a security’s current price, through to those who believe opportunities exist to exploit market inefficiencies, therefore generating a return exceeding the benchmark return2. In particular, studies have questioned whether developments in the relatively new area of behavioural finance provide contradictory insights into how markets behave3.

Activity

Do some digging into the Efficient Market Hypothesis. What do you agree or disagree with? Note down what variation of the Efficient Market Hypothesis resonates with you, or do you believe markets are inefficient?

Is there a simple statement that captures your take on the Efficient Market Hypothesis? When you capture this, it in no way needs to mention the theory at all, it is merely a tool to form your core opinion or belief on this specific part of markets and how they behave.

Narrowing down the list

This process will take some time, but hopefully you have built a collection of statements or expressions that capture your core beliefs when it comes to investing.

However, you still need to narrow them down, as what you are looking for here is the statement you truly believe in, what you stand for, where you could debate with conviction due to what you’ve seen and experienced.

Therefore, the filter to apply to your list, is which ones do you feel passionate about? What are the beliefs that, when you start talking about them, you end up waxing lyrical about? Conversely, are there any statements your eyes skip over, that you’re less interested in?

Ultimately, a thoughtful and helpful summary of your investment beliefs will include:

• 3 – 5 fundamental beliefs, certainly no more than 10

• Each belief can be stated in 4 or 5 words

• They don’t use big words when a simple one will do

• With a short description explaining the why behind each of them, in 2 or 3 sentences

One final suggestion on this – your investment philosophy will resonate far more powerfully with your clients if you steer clear of the technical. There may be technical statements you feel are fundamental to investing, but you need to take the time to transform them into layman terms. This will ensure your clients can both absorb them, and easily repeat them, which is when you know we’ve really nailed your core investing beliefs!

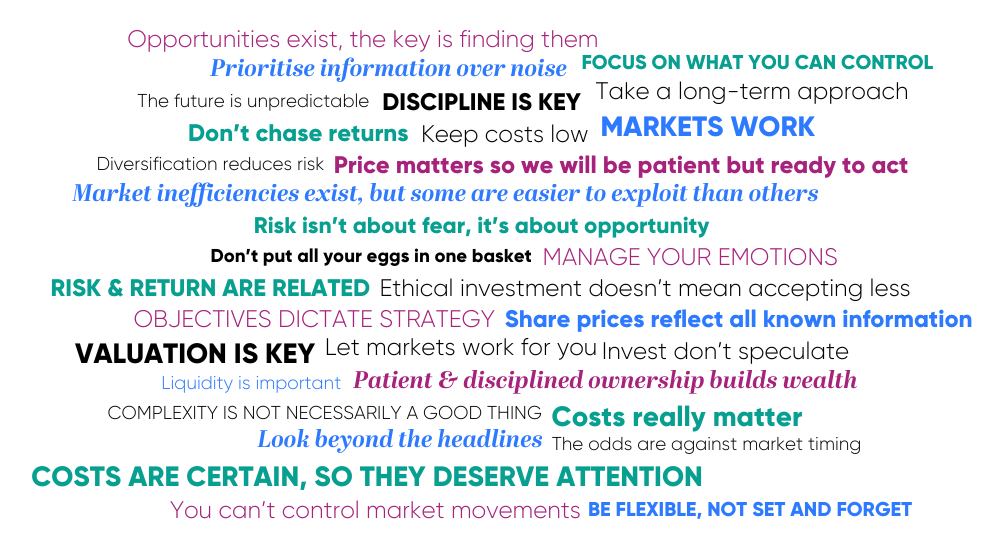

As we’ve said before, these beliefs are personal, and therefore identifying them cannot be about copying someone else’s. However, to give you a kickstart, we have collated some of the expressions other investment professionals have used to share their investment philosophy.

Some might directly oppose your beliefs, in fact many directly contradict each other. Some might feel too wordy or technical. But no matter what your take is, use the reaction to each of them to further refine your own investment philosophy and core investment beliefs.

Selecting an Approach

So, you have established a list of core investment beliefs you have strong conviction on, no matter what type of client or investment situation may apply. The next step is to determine your Investment Approach.

As we covered earlier, your Investment Approach is heavily influenced by your beliefs, however it works out what general “school of thought” you intend to use to apply to bring your core investing beliefs to life.

But what if you come up with your own unique approach?

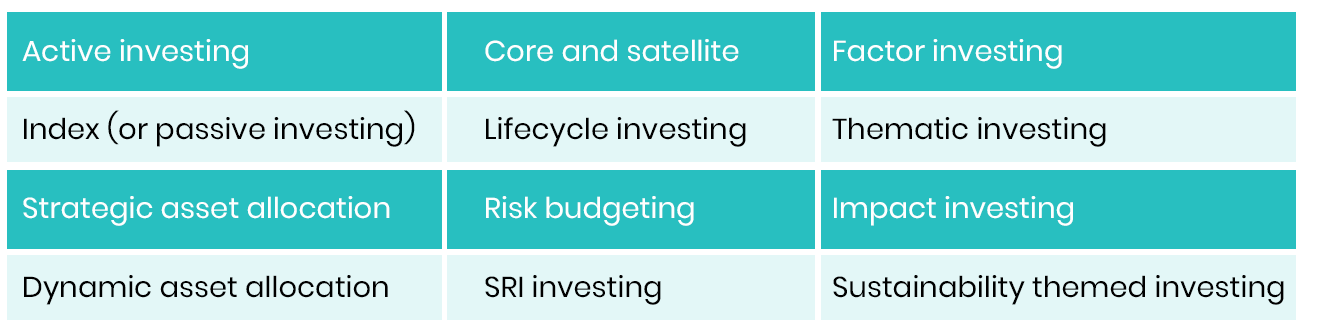

Well, this is absolutely fine, as this is all meant to capture your take on investing, however by taking a look across the approaches for the breadth of advisers out there, experience says that while you might think your approach is unique, it will generally look similar to one of the following:

Your approach may be a blend of two of these, or use one as the core of your approach with your own refinements. However, you are going to use these headline investing approaches to help you identify what your particular take might be.

And this is when you can start to get a little more scientific.

Because the digging you do into the options out there, and the conclusions you’ll make, form the basis of your investment research moving forward. And by capturing this process well, should you wish to revisit one of the approaches down the track, you can piggyback off the work you did here, rather than second guessing yourself and doing rework.

An Investment Approach Research template

You therefore need to come up with a template to capture the research you do into each of the approaches available to you, what filter you have applied to each of them and therefore the conclusion you have made on whether that particular approach may apply to your clients.

This document should ideally have consistent headings and question prompts to ensure your research covers the same areas and with the same amount of depth across the different possible approaches. This is an effort to try and overcome your own enthusiasm, and to combat your own bias towards the familiar.

The areas you wish to focus on as part of your research will be heavily influenced by your core investing beliefs, however some prompts for you to consider as you look into each Investment Approach are:

• How does it measure up against core belief #1

• How does it measure up against core belief #2

• How does it measure up against core belief #3: You get the drift, consider the approach against every belief, as this is often where you manage to immediately cull some of the possible approaches

• Will it work for your target clients? Will the cost of the approach plus the cost of your time to implement it be palatable to your target clients? Is it flexible enough to meet their needs?

• Will your target clients understand it? Is the approach too complicated for your client base? Do you have sufficient understanding of it to translate and clarify it for them?

• What limits may apply? Does your licensee allow it? Do you have asset allocation restrictions this approach may butt up against? Will you be able to apply this approach across platforms?

• Will it withstand the test of time? How wedded to current fads or trends is the approach? Does it take a long term view?

• Can your team implement it? Will you be able to implement this approach, or will you need additional resources, expertise or even systems? Is it scalable and can it therefore be profitable?

• Where won’t it work? In what instances will this approach simply not be possible? Will that be the exception, or the rule (i.e. will this happen more often than not)?

• Action items: What further research, or even further knowledge do you need to gain to assess this option, or to apply the approach?

• Conclusion: Should this be on or off the list of possible Investment Approaches?

As you can see from the sort of areas to cover, these documents will remain open for a while as you work through collating insights into the approach and will often require further digging and enquiry. In some cases, you may even wish to chat to a fellow adviser who is already using a particular methodology.

Activity

When you hit an approach you are struggling to get to the bottom of enough to answer the questions you have, reach out to other advisers letting them know which one you are looking at and ask for their insights.

There is no reason you need to go this alone. Many advisers before you will have taken the same path, digging into the various ways they can invest clients’ money. So reach out to your dealer group, other adviser members of your dealer group, and be sure to head here in the Ensombl Schroders Investment space and ask other advisers for assistance. Be specific and transparent about what you can’t get to the bottom of. You can also connect with Sophie Metcalfe, Account Manager and host of the Schroders space who can share insights into how Schroders’ advisers have formed their investment approach.

When you document this research, be sure to include citations of resources you used, ideally including links to online resources, or links to downloaded white papers you’ve reviewed.

Making a Decision

The process of thoroughly researching each of the investment approaches should result in at least a shortlist of approaches you feel fit your beliefs and your clients.

Sometimes there is one that stands out as the perfect fit, however if you are left with a couple to choose from, then take the opportunity to dig deeper into the client experience of each. What will provide a better learning experience for your particular client base? What best matches their level of experience, comfort with technology and engagement level?

And if you are still struggling with a decision between two options, reach out to your investment book club or a group of advisers in the Ensombl Schroders Investment space and ask them for 30 minutes for you to pitch the two approaches and see what feedback they have.

External perspectives can make such a difference when you have been immersed in researching something for so long. This level of collaboration is common in other professions like medicine and law, and so it makes sense for it to become more common in financial advice.

However, to ensure the discussion is worthwhile, you need to be able to position your core investment beliefs first, along with a detailed profile on your target market so they can provide you with feedback in that context. This will work particularly well when at least one member of the group has core beliefs or an investment approach directly opposed to yours. Their questions are likely to be challenging, however will probably help you narrow down your own decisions.

And ultimately the test of your decision is your level of conviction. Can you defend your core beliefs and selected investment approach to others? To your peers? To your clients? Because without conviction, not only will the way in which you implement drift, but you will most likely experience more uncertainty from your clients on your approach as they sense your own uncertainty.

PART 2: UNEARTHING YOUR INVESTMENT PHILOSOPHY

In Real Life – Determining Your Investment Methodology

Now that you’ve nailed down your core investment beliefs, and the approach you wish to take, then the last step is to turn this into a process and an experience … your Investment Methodology.

How are you going to deliver your Investment Approach to your clients? This area includes details of portfolio construction and internal administration processes, along with governance frameworks for ongoing research and monitoring of your approach and methodology.

Insource versus outsource

There are opportunities to outsource portfolio design and construction, along with the full implementation of the portfolios via model portfolios and separately managed accounts.

This comes down to the capability and capacity of your teams. Do you have the insight, experience and know how to keep on top of investment research and portfolio construction decisions, and aside from that, is that the best use of your time?

This will be different for everyone, however depending on the approach you select there will be an important question to ask yourself:

“If I believe an active approach is the right fit for my core beliefs and my clients, then how active do I want to be?”

By being honest with yourself on this, you can determine how much you insource versus outsource. And if you find yourself heading towards an Investment Methodology that will see you immersed on a daily basis on research and portfolio construction then the next question to ask yourself is:

“If this is how I want to spend my days, then do I in fact want to be a fund manager, rather than a financial adviser?”

Ultimately, this level of immersion in investment research needs to be something you are passionate about for it to make sense for you to provide it as part of your client value proposition. Advisers that fall into this category behave this way with their own money and can talk about investments for hours on end.

And depending on your target market, then perhaps you do provide a service focused on active investment advice that takes positions on specific shares, regions and industries. In fact, this may be what attracts your target client to you. And perhaps you have a longer term plan to grow your business to the point where you can then become the Chief Investment Officer. However, it is important you check in with yourself on what your expertise and focus is going to be, and then either outsource or adjust your solutions accordingly.

You need to pick a lane, and know why you picked it.

Manager Selection

No matter the approach you choose, and what level you choose to outsource, you are almost certainly going to need to then research fund managers or portfolio construction consultants as part of determining how you are going to proceed.

The following is a list of questions the advisers we have talked to suggested they use as part of the research process into investment experts. We have also asked the Schroders Investment team to provide the toughest questions they get asked, along with what they would ask their competition.

You may not use all of these questions, however creating your own ‘Investment Expert Investigation Cheat Sheet’ with the questions that best suit your investment beliefs, approach and client base will help you gain the answers you need without wasting your time. Consider also sending at least some of the questions to your contact before the meeting so they have an opportunity to get you the information you need, as this can make these meetings even more fruitful.

This level of questions will most likely test a BDM’s knowledge, therefore don’t be surprised if they then suggest you meet with a member of the investment team. However, a BDM is certainly a place to start, and can help filter who you then dig deeper into.

So take your pick from the following discussion prompts:

• Why should I use your portfolio construction approach, when that is something I as the adviser could do?

• What do you believe in as an investor? Show me how the decisions you’ve made align to those beliefs?

• Then, what do you believe in as a fund manager? What do you believe your responsibility is for the end investor?

• What do you know that most investors don’t?

• How much of your money is invested alongside the clients?

• What are the biggest holdings currently in the fund? [Then be the devil’s advocate and test whether their process matches their decision to hold those investments]

• What does success look like?

• Every approach has its moments where it does well, what is it about the way you invest that gives you confidence that you can deliver across the cycle and when conditions change?

• And more specifically, tell me how you have adapted your investment process to invest in the post covid world of higher volatility and uncertainty around both growth and inflation.

• What keeps you awake right now? Or what’s the worst that could happen?

• What is wrong with your process? What challenges are you currently facing?

• How can you achieve both good returns above inflation and manage downside risk to avoid big drawdowns?

• How much of what drives your investment decisions is in your firm (or teams) DNA and how much is driven by individual portfolio managers?

• How have you evolved your decision-making framework to different economic environments or regime shifts?

• What are some of the losing choices you have made in the past, and what have they now made you do differently?

• You’ve provided historical results against a benchmark, why is that the most appropriate benchmark for this fund?

• How do I explain this investment to my clients?

• Where do you think the advice industry needs to think differently about how we invest?

Other elements to research and consider

Even if your approach excludes some types of investments, the internal investment methodology should demonstrate as many things have been considered as possible, and what conclusion you have reached, even if they are then dismissed.

This includes things like:

• Does Private Equity have a place? How do you feel about a different level of transparency into a manager’s underlying investments?

• What about Crypto?

• Have you considered the breadth of fixed income options and how they apply to our approach?

• What is the bias towards Australian equities and other investments? And is that appropriate for your clients and your approach?

• What about Hedge Funds?

• How will you consider and potentially include Alternative investments?

This is not a comprehensive list, in fact it will most likely build over time as new innovations occur in investments, products and services. However, the more questions you keep asking, the better your overall Investment Philosophy will be.

Activity

Activity

What gaps in understanding has this process identified for you? Note them down, and then outline whether this is a matter of CPD reading or whether more involved training is required to address these?

Once again, there is no reason we all need to gain further understanding alone. The Ensombl Schroders Investment space has resources on Private Equity, Fixed Income and a number of other investment classes, and there are also discussions between advisers on Alternatives and topics like Crypto. And should the information you’re seeking not be available then reach out to Sophie Metcalfe – your host of the Schroders space on Ensombl – who can seek answers to your questions, by tapping into Schroders’ resources, including their Fund Managers.

What are the possible variables?

Each practice will be different on how deep the Investment Methodology goes, and how much they leave in the hands of individual advisers, however the sort of questions to at least debate as a team are:

• How will we apply this across different platforms?

• What will differ between risk profiles?

• What are the adjustments for wealth accumulation versus drawing an income for retirement?

• How will we transition current clients across to this Methodology?

• How often do we intend to make changes to client portfolios? Will we rebalance regularly, or will we allow some drift from targets to manage costs?

• Do our return assumptions need to change for any modelling we do for clients?

• What exceptions can be handled by the adviser, and what should be escalated to the team for discussion?

Whatever you agree on as a team, then needs to be captured in your Investment Philosophy documentation.

How will we handle exceptions?

Invariably there will be client situations that don’t fit within your Methodology. This may be a particular request they make, or maybe a situation they are in, or even a platform they already have money invested in. It is important to consider upfront, where you will be happy to tweak your methodology, and where you will instead refer the client out.

Many of the advisers we spoke to have a clear idea of what fits and what doesn’t, and have even taken the time to develop a list of advisers they are happy to refer clients to who don’t fit their Methodology.

Draft your full Investment Philosophy

The draft of your full Investment Philosophy should include, but will not be limited to:

1. Your investment beliefs

2. Your selected approach and why

3. Your portfolio construction process and how it will be applied in practice including exception handling

4. Appendices including the most recent round of research you have done into approaches and funds

You should be able to provide enough detail here an experienced adviser could pick it up and apply it to a client. It can help to get another member of the team to read through the document to see whether they feel they could simply take it and run with it, and potentially highlight any areas that might require more explanation or thought.

Test it

Depending on how closely you develop ideas with your licensee, then at this point you can either send the Draft Investment Philosophy document to your licensee for their input, or you can undertake some simple testing of it first.

The idea here is you use the framework you have provided in the document to respond to a variety of scenarios and situations. Consider using client portfolios you have previously worked on as sample scenarios and then rigidly apply the Philosophy and Methodology that you have come up with.

Were there any gaps in what you needed, to be able to apply it? Were there any exceptions you needed to make to come up with an appropriate solution?

Similarly, key historical market conditions can be a useful test of a methodology, particularly as a lens through which we ask – “How would the framework this philosophy provides stand up during this combination of market movements and signals?”.

This testing process is also worth capturing as part of the appendices in your Investment Philosophy document, and of course if you haven’t already, be sure to run it past the licensee.

Finalise and create collateral

At this point, you should be close to having a completed Investment Philosophy document as outlined above. Even if your intention is to keep this as an internal document, then be sure to:

• Date the document, on the cover and in the title

• Save it as a pdf

• Collate any supporting materials together with it

• Save it in a place that any team member can find and access in the future

For some practices, that is far as they wish to go, however there are multiple ways to leverage all the work done, well beyond how it will apply in the day to day with clients:

• Team presentation – create a presentation stepping the entire team through the core beliefs, the underlying research done and the resulting Methodology. Questions are very likely, therefore be ready to respond on specific “how to’s” as they relate to the support staff implementing the advice produced.

• Client brochures – consider getting a one pager designed of just your core investment beliefs, often this can be powerful enough to provide initially to clients. Then you could also get a more detailed white paper designed to include your approach and methodology. And if graphic design costs aren’t currently within the budget, check out a tool like Canva with document templates you may be able to tweak to your branding.

• Repurpose for referral partners – the core investment beliefs one-pager could be a fantastic tool to be repurposed for referral partners to either keep them in the loop, or even to pass on to their clients.

• Recruiting filter – utilise the paper as a discussion point in interviewing new advisers and paraplanners – what is their take? Does this align with their beliefs?

• Website materials – is there value in adding a page on your core investment beliefs on your website? What else might add value to prospective clients who go there to check you out?

Embed in your Practice

And then it is a matter of ensuring the Philosophy and Methodology are completely embedded in your practice.

When it comes to engaging staff on the topic, once you have done the initial presentation to the team, depending on their level of interest you can encourage their curiosity about investing and markets by offering the option of a Team Book Club. This could cover business, marketing, investment, money and all sorts of other books, and can be a great way to align your team and inspire creative ideas to challenges you are facing together in the business.

And of course, you have an opportunity to revitalise the way you communicate with your clients too:

• Video series to utilise as part of the advice process – this could be three short videos designed to lift the client’s understanding of markets and your unique philosophy. By taking the time upfront to help clients understand your investment philosophy not just academically, but also how you will react to major market events, then the less reactive behaviour clients are likely to exhibit down the track.

• Advice document inserts – it makes sense to ensure you have advice document inserts ready for the overall description of your Investment Philosophy.

• Client discussion scripts – by collating these with your advice team, you can develop more comfort with handling these conversations. You can even go so far as in very early discussions with a client, preposition their likely responses to market movements up and down … “ You’re going to _______ when ____ happens. However our approach will be ___ because ____”

By prepositioning this with the clients before it happens down the track, you are providing a new lens for them to view that very situation down the track. You are helping them develop a reflective response, rather than a reactive one.

• Anecdote and analogy list – it can even be helpful to create a list of useful anecdotes of behaviours in particular situations, or even analogies to help clients grasp a particular concept. Note these down so the entire team can benefit from them.

Overall, take the time with the team to consider all the ways a more succinct Investment Philosophy can be utilised within the practice. And you should definitely celebrate completing a huge project!

Activity

Share the resulting client facing document with your fellow advisers. Be proud of the work you have put in, and the resulting document!

Head over to the Ensombl Schroders Investment space and share the result of all this effort! Be willing to discuss what you discovered about yourself, and your beliefs as part of the process, and be sure to share what impact it has had as you have rolled it out to your team and your clients.

Maintaining your Investment Philosophy

Many before you have produced Investment Philosophy documents, however most of those documents have ended up lost in the archives, never to be seen again.

Instead, you need to view your Investment Philosophy as a living, breathing document that needs to be maintained. And to ensure this happens, you would ideally set a cycle of when you will revisit it – this could be annually, quarterly, whatever seems right to you, however it makes sense at least initially to have this set as an annual calendar item for the business.

During this revisit, the process could include:

• Reflecting on the past year in investment markets

• Rereading the foundational investment books that helped form some of your core investment beliefs. Did the last year reinforce them, or did it challenge some of them?

• Seeking out opposing views and investment approaches and lining them up next to your own

• Getting feedback from the team on implementation and administration challenges when it comes to investments for clients

• Review each of the fund managers used. Consider using this cycle as a way to align fund manager meeting requests with when you need their input. Therefore when they reach out during the year, suggest they set a reminder for the month prior to the scheduled Investment Philosophy Review meeting and give them a list of information that would assist during your review. Even consider having a video meeting with them prior to the meeting and recording them to be shared with the rest of the team to discuss during the internal meeting.

• Watch out for mutant portfolios. This can occur when you decide on using a particular model or approach, however in practice it ends up getting tweaked so much it is unrecognisable from the original intention. Conviction is key to this not occurring, however it is worth having this as a discussion item to keep the entire team on the same page.

• This maintenance cycle can also be something stated in your original Investment Philosophy document, along with the areas you intend to cover as part of the process. This is a great way to ensure strong governance within the business.

The one thing you need to keep in mind is this is not intended to be a complete rework of your Investment Philosophy. If the initial work has been thoughtful and thorough, then each review of the philosophy should apply as follows:

• Philosophy and core investment beliefs: These are unlikely to ever change. And if they do, it may be that we manage to better enunciate them over time, or narrow them down even further.

• Investment Approach: As this is a focused way to deal with your core beliefs, but relies on what options are available out there, then it is possible your approach could change in response to changes in technology or information access as an example. However you wouldn’t expect this to change annually for example.

• Investment Methodology: As the part dealing with the methods and tools you use to implement your Investment Methodology, then you are far more likely to be making changes here. This is likely to evolve over time due to new funds, new platforms, and new client requests.

When do you need an Investment Committee

As you set up this type of governance process, it can be natural to question whether you then need a more formal Investment Committee.

The general consensus when talking to advisers is this can make a lot of sense when you have a bigger team, multiple advisers and therefore have more voices and more opinions to work through and consider.

This lends itself naturally to more structure to consider the variables more frequently than at an annual Investment Philosophy review.

In addition, a flag for the need for an Investment Committee can also be when you are making far more frequent tweaks to the portfolio construction within your methodology.

However, in all the businesses we chatted with, the Investment Committee had a well thought out Investment Philosophy to work from and to use as a framework moving forward.

Therefore, the simplest response to the question of needing an Investment Committee?

Investment Philosophy first. Investment Committee second.

Summary

Developing and then maintaining an investment philosophy within your business will take time.

By rigorously developing your investment process we can move from a constant state of reactivity to a reasonable, reflective style of thinking ensuring your opinions are based on facts and can help you sort through all the market noise and new trends, encouraging logical decision-making with an open-minded approach.

This isn’t about picking and rigidly sticking to one approach.

Instead, it’s about using core values as a decision-making framework to determine what to believe and then what action to take.

This document is issued by Schroder Investment Management Australia Limited (ABN 22 000 443 274, AFSL 226473) (Schroders).

This document does not contain and should not be taken as containing any financial product advice or financial product recommendations. This document does not take into consideration any recipient’s objectives, financial situation or needs. Before making any decision relating to a Schroders fund, you should obtain and read a copy of the product disclosure statement available at www.schroders.com.au or other relevant disclosure document for that fund and consider the appropriateness of the fund to your objectives, financial situation and needs. You should also refer to the target market determination for the fund at www.schroders.com.au. All investments carry risk, and the repayment of capital and performance in any of the funds named in this document are not guaranteed by Schroders or any company in the Schroders Group. The material contained in this document is not intended to provide, and should not be relied on for accounting, legal or tax advice.

Schroders does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this document. To the maximum extent permitted by law, Schroders, every company in the Schroders plc group, and their respective directors, officers, employees, consultants and agents exclude all liability (however arising) for any direct or indirect loss or damage that may be suffered by the recipient or any other person in connection with this document.

Opinions, estimates and projections contained in this document reflect the opinions of the authors as at the date of this document and are subject to change without notice. “Forward-looking” information, such as forecasts or projections, are not guarantees of any future performance and there is no assurance that any forecast or projection will be realised. Past performance is not a reliable indicator of future performance. All references to securities, sectors, regions and/or countries are made for illustrative purposes only and are not to be construed as recommendations to buy, sell or hold.

Telephone calls and other electronic communications with Schroders representatives may be recorded.

01 Chris Hohmann, ‘Approach, philosophy or methodology?’ https://hohmannchris.wordpress.com/2014/10/30/approach-philosophy-or-methodology/

02 Rebecca Baldridge, ‘What is the Efficient Market Hypothesis? ’, Forbes Advisor, May 2022 https://www.cfainstitute.org/en/research/cfa-digest/2003/11/the-efficient-market-hypothesis-and-its-critics-digest-summary

03 Burton G. Malkiel, ‘The Efficient Market Hypothesis and its Critics’, Journal of Economic Perspectives, Winter 2003 https://www.cfainstitute.org/en/research/cfa-digest/2003/11/the-efficient-market-hypothesis-and-its-critics-digest-summary