Adviser at the Helm: How to Guide Clients Through Sustainable Investing to Build Trust and AUM

This is Part IV of the series Behind the Behaviours: Using Revealed Preferences to Understand What Clients Can’t Tell You

The research is clear, sustainable investing (SI) is not a passing fad. But it is a giant gap.

Recent data shows nearly 60% of Australian investors place high importance on SI factors in their investing. However, only 13% are highly confident their current portfolio reflects their values.i

It’s no wonder this chasm exists. Most SI interested investors love the idea of aligning their investments to their values, but they often don’t know what’s even possible. The SI world is a blizzard of terms, concepts, and products, with greenwashing swirl laid over top. As a result, it’s hard for investors to see what’s possible and know what their SI preferences are. And for advisers, trying to tease out those preferences can sometimes feel like walking on eggshells/politically charged topics.

A gap worth closing?

So there’s an SI interest-to-confidence gap. Is it worth closing?

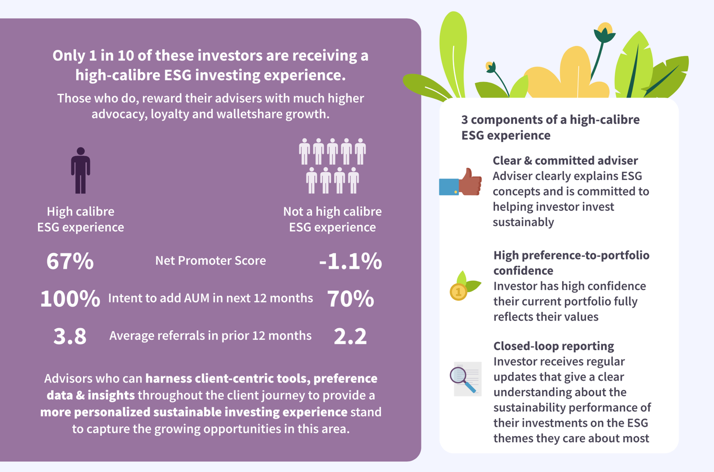

While 60% of Australian investors are SI interested, just 1 in 10 are receiving a high calibre SI investing experience. The advocacy, intent to add AUM and referral rates of the 1 in 10 are eye-popping when compared to the 9 – sixty+ point swing in Net Promoter Score, higher intent to grow AUM and more referrals.

The opportunity is large for advisers who can deliver a better SI-investing experience. Those who have report that it creates an additional, powerful narrative for portfolio performance conversations. The SI conversation can sit alongside (or even supercede!) the long-bemoaned returns-centric narrative that clients often default to, which undercuts focus on long-term goals and wealth building.

How to be The Closer

Closing this gap starts with helping clients discover their own SI preferences. Of SI-interested investors, only 34% can identify how much of their portfolio should be ESG-oriented (Environmental, Social, Governance), and even fewer (27%) know how they want E, S and G pillars represented in their portfolio.ii Most investors don’t know how to wrap their minds around it.

An analogy helps explain this challenge. Imagine going back in time to 1997 and telling a mate about smartphones. They’d say, ‘Wicked! I want one.’ Great. You bring them back to 2023 and take them shopping to choose their new smartphone. The 1997er wouldn’t know where to begin or even how to think about the dimensions of preferences. “App store? What even IS an app? And what do you mean by ‘wireless charging’?”

Same with SI. Some education – and a whole lot of simplification – is needed. And, ideally, a way to suss out a client’s true preferences.

Mend the Gap

Advisers can close the SI interest-to-confidence gap by providing an investing experience that:

• Simplifies a complex landscape

• Educates on the core set of preference dimensions

• Then lets clients make a series of decisions that reveal their preferences

In part I, II and III of this series we focused on risk preferences – how people trade off risk and return. In the SI domain, we’re especially focused on what economists call “social preferences” – how a person trades off their own wellbeing vs. the wellbeing of others.

Social preferences are highly individualised. For most clients, the preference dimensions that matter in SI are:

• SI themes – whether it’s E, S or G… or something more granular like renewable energy.

• Impact style – how does your client prefer to make an impact? Do they want their investments supporting companies with good SI records in the themes they care most about? Or do they want to invest in companies creating solutions to the problems they care most about?

• Exclusions – are there activities, such as gambling, your client does not want their investments aligned to?

• Altruism – this is the tradeoff between impact vs. returns/fees/diversification – at some level, there is almost always a tradeoff between making an impact with SI and less diversification (or possibly higher fees/lower returns).

Sussing out a client’s preferences on all these domains is tricky. And many ESG domains are also politically charged territory. Here’s where revealed preferences come into the picture to do the heavy lifting.

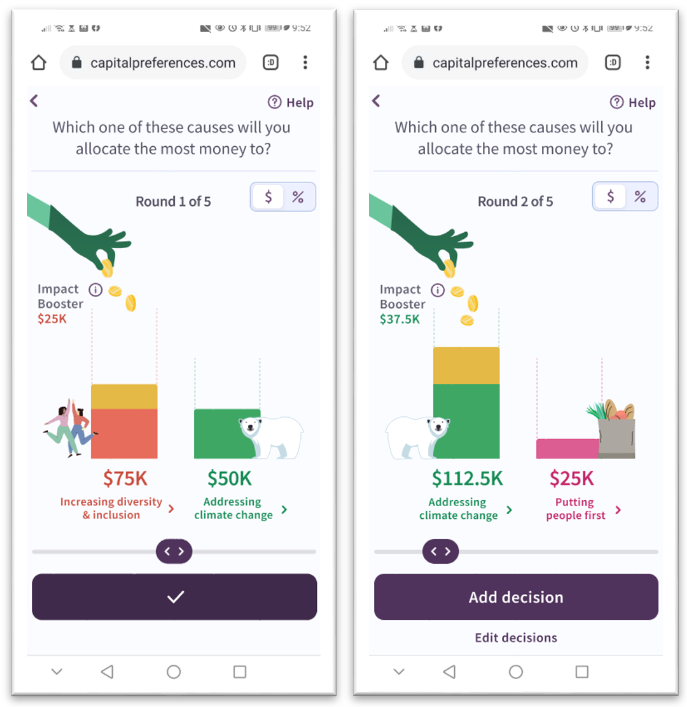

As a reminder from Part I of this series, revealed preference methods combine standard and behavioural economics with decision science and gamified experiences. They let us precisely measure preferences through a client’s decisions, so we can detect hidden wrinkles in their preferences that clients couldn’t express themselves, and that no questionnaire could pick up.

How to use revealed preferences in a SI context?

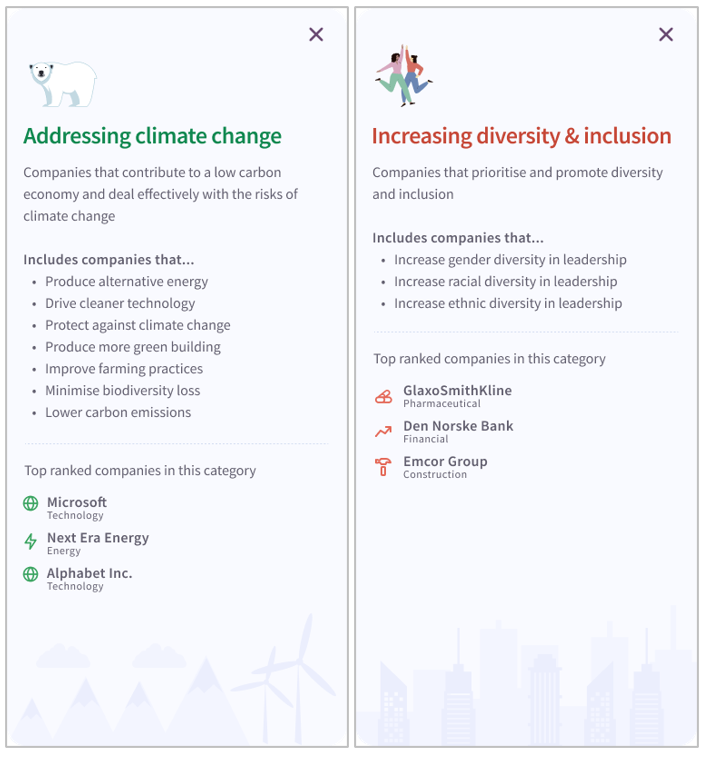

As noted above, a high calibre SI investing experience has to start with some simplification and education for the client. We’ve used our own tool to illustrate this. Within it, the 17 United Nations Sustainable Development Goals (SDGs) have been distilled into 5 themes: addressing climate change, increasing diversity and inclusion, behaving ethically, protecting natural resources, putting people first. Clients are given a chance to explore each theme and familiarise themselves.

This speaks to just how personal SI is for clients who view it as important.

From personalised preferences to personalised portfolios

Because revealed preferences is mathematics-based, the preference data can be used alongside ESG ratings data to score potential portfolios for personalised fit.iv A standardised score – call it Sustainability Match – can be assigned to that fit assessment. Based on ESG ratings, one portfolio might be a 97% Match to your unique preferences, while another may be only 52%.

Now, recall back to the SI interest-confidence gap. You can see what this approach has done to help advisers close that gap.

• Client sense of agency — they’ve learned about SI without being overwhelmed, and stretched their decision-making muscles to make trade-off choices.

• Adviser empowerment – advisers can draw a clear line from the decisions a client made through to their preferences and ultimately their best fit portfolio.

• Client confidence and trust – clients gain confidence and trust, because they understand the dimensions of SI and see how their decisions map to their portfolio.

Advisers who then report on the SI performance of the portfolio – in relevant and meaningful terms – can create the closed loop back to the client. From education, to discovering preferences, to fitting portfolio, to reporting on impact against the client’s preferences.

The big picture: deeper client understanding leads to more personalised experiences

Revealed preference methods are the equivalent of modern medical diagnostics. They give advisers a way to account for multiple dimensions of diagnosis (i.e., preference domains like risk and SI), for a highly personalized “treatment” path.

However, modern medical diagnostics have not replaced the physician, nor physician/patient dialogue. Rather, they make physicians and medical treatment consistently more effective and efficient.

And that’s the era that advice is entering. Advisers and their clients stand to benefit in the same ways that physicians and their patients did. Deeper understanding builds trust and confidence, and enables more personalised advice experiences. It helps advisers stay ahead of client behaviours, and keep them on the path to long-term financial wellbeing in a way that suits each client as an individual.

You can access more information on how revealed preferences can be used within your business and with clients, here.

i ESG is Personal: A Study of ESG Investing Preferences & Advisory Practices, Capital Preferences 2022. SI factors include: Investing my money to align with my values; Actively steering my investments to companies with good ESG records; Actively steering my investments to companies who business is to solve Environmental and Social problems. n = 313 Australian investors.

ii Ibid., p. 6

iii Ibid, p. 8-9

iv Revealed risk preferences can be integrated with revealed sustainable investing preferences. Because revealed preference is mathematical in nature, preference data can be used in sequence to first pinpoint a risk-based portfolio composition, followed by combining SI preference data with ESG ratings data to finetune the portfolio to a client’s SI preferences.